About Direct Payday Loans

Wiki Article

The 30-Second Trick For Payday Check Loans

Table of ContentsThe Only Guide for Fast Payday LoansAll About New Payday LoansSome Ideas on Payday Direct Loans You Should KnowThe Best Strategy To Use For New Direct Loans

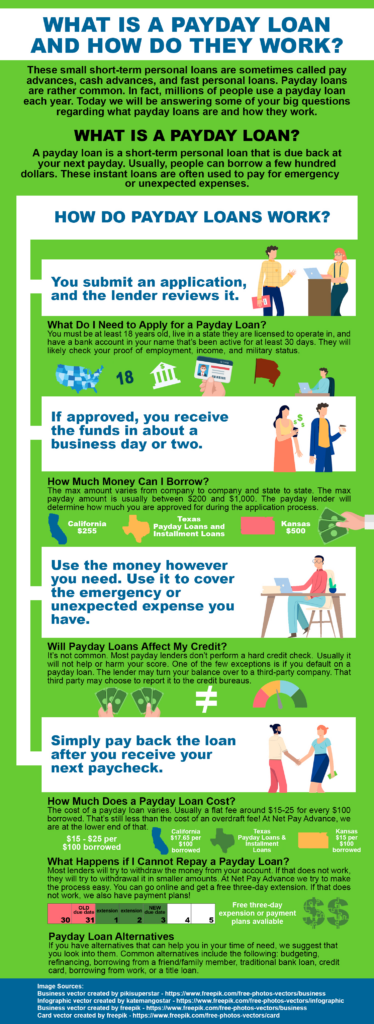

One is that many people who turn to cash advance do not have various other financing choices. They may have poor credit rating or no earnings, which can stop them from getting an individual loan with better terms. Another reason might be a lack of understanding about or anxiety of alternatives. Some people may not be comfortable asking household members or pals for help.

Some states, including Nevada and also New Mexico, likewise restrict each cash advance to 25% of the debtor's monthly income - Check Cash Payday Advance Loans. For the 32 states that do allow cash advance loaning, the expense of the financing, costs and the maximum finance amount are capped.: 37 states have specific statutes that permit cash advance lending.

The Greatest Guide To Check Cash Payday Advance Loans

07. If the funding term were one year, you would increase that out for a complete yearand borrowing $100 would certainly cost you $391. Your loan provider must reveal the APR prior to you accept the lending. While it's common to see an APR of 400% or greater, some payday finances have actually lugged APRs as high as 1,900%.Actually, the CFPB located that 20% of payday customers default on their car loans, as well as more than 80% of payday car loans gotten by borrowers were surrendered or reborrowed within 1 month. Some cash advance loan providers will certainly supply a rollover or restore attribute when permitted by state law. If the loan is established to be due quickly, the lender allows the old financing debt to surrender into a brand-new funding or will renew the existing loan once more.

This gives the borrower more time to pay off the loan as well as fulfill their contract. It also suggests racking up huge fees if they continue in the cycle.

That said, they can appear on your credit scores report if the financing becomes delinquent as well as the loan provider sells your account to a collection firm. When a debt collector purchases the delinquent account, it has the alternative to report it as a collection account to the debt reporting bureaus, which could damage your credit score.

Getting The Payday Check Loans To Work

They likewise have a tendency to supply longer payment terms, offering you even more breathing room. Since it normally uses a lower rate of interest rate and also longer repayment term, a debt consolidation lending can have a reduced month-to-month repayment to assist you handle your financial obligation payment (https://moz.com/community/q/user/ch3ckc4shl0ns).Not all states allow cash advance financing, however those that do call for payday lending institutions to be licensed. If a cash advance lending is made by an unlicensed lender, the loan is considered gap. This suggests that the loan provider does not deserve to gather or call for the consumer to settle the cash advance loan.Each state has different regulations pertaining to cash advance financings, including whether they're available through a shop payday loan provider or online.

A cash advance car loan can solve an immediate need for money in an emergency scenario. Nevertheless, due to the fact that these finances typically have a high APR, if you can not pay it back in a timely manner, you can obtain caught in a vicious circle of debt. Base line: It's crucial to take into consideration all your over at this website options prior to coming close to a cash advance lending institution.

Some personal lenders specialize in working with individuals with poor credit report. And while your passion prices will certainly be greater than on other individual fundings, they're a lot lower than what you'll obtain with a payday loan.

How New Direct Loans can Save You Time, Stress, and Money.

And if you have bad credit, make sure to inspect your credit report and report to figure out which areas need your interest. In some situations, there might be incorrect information that might increase your credit rating if eliminated. Whatever you do, take into consideration means you can improve your credit history to ensure that you'll have better as well as even more cost effective loaning options in the future. https://penzu.com/p/a15ac6e7.

Money advancements are typically for two-to-four week terms. Borrowers with credit scores difficulties ought to seek credit rating therapy.

Money advances subject to relevant loan provider's terms and problems - https://www.huntingnet.com/forum/members/ch3ckc4shlns.html. ** Transunion Credit History, View Control panel is a 3rd celebration offered solution.

Report this wiki page